Our Investment Approach

Africa is a generational opportunity, based on the continent’s scale, rich natural resources and the world’s youngest working population. Improved political stability and transparency have been assisted by the digital revolution, which is also helping overcome traditional infrastructure deficiencies in education, financial services and healthcare.

Great businesses are built from the bottom up and good entrepreneurs have always been present in Africa, often below the radar. Our approach at Arkana is to uncover those management teams and shareholders who want to take advantage of the new opportunities to accelerate growth. We have local knowledge and provide partnership with advice and capital to deliver shareholder returns.

ARKANA Partners' investment approach is:

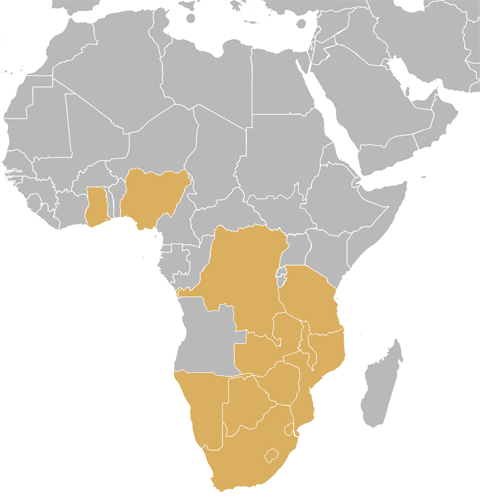

- We focus on core markets in South and West Africa where we have a local presence or knowledge

- We look for ambitious growing companies and teams that want partnership

- We need the industries we invest in to offer high returns on the capital we commit

- We identify operational improvements that the management teams we support can deliver

- We require strong ESG compliance based on United Nations PRI

- And, ultimately, there needs to be an exit plan that allows shareholders to monetise against agreed parameters.

Our strategy is based on our experience of successful investing in Africa

Early to Mid-stage Growth

- Our emphasis is on growth to drive returns, and experienced management to deliver the detailed plans

- We will stay closely engaged with the businesses we support

- We have a flexible approach to how our capital is structured, from equity to mezzanine loans, to meet the needs of the company and shareholders, as well as our own investors

Structural Under-Penetration

- Industries with attractive fundamentals underpinned by secular growth

- Fast Moving Consumer Goods & Services, Financial Services, Healthcare, Education, Business Services, Telecommunications, Media & Technology

Alignment with management teams looking for support

- Focus on credible management teams with demonstrable experience

- Alignment of financial interests through executive shareholdings or long term incentive plans

- Active board engagement with open decision-making and good governance

Value from portfolio improvement

- We work with management to identify and agree actionable and specific operational improvements

- Where needed we will second Arkana operational executives to portfolio companies to assist with projects

- Our experience is that much value is created by optimising basics such as good management, information systems, a focused strategy and strong employee engagement

Focus on countries where we have relationships